Engaged to overhaul Corporate Performance Management (CPM) hindered by complex Excel models, Exent implemented a streamlined approach with a target-state architecture. The result: a modernised CPM technology, streamlined processes, improved decision-making, efficiency gains, and risk mitigation—all endorsed on the first pass.

The Client

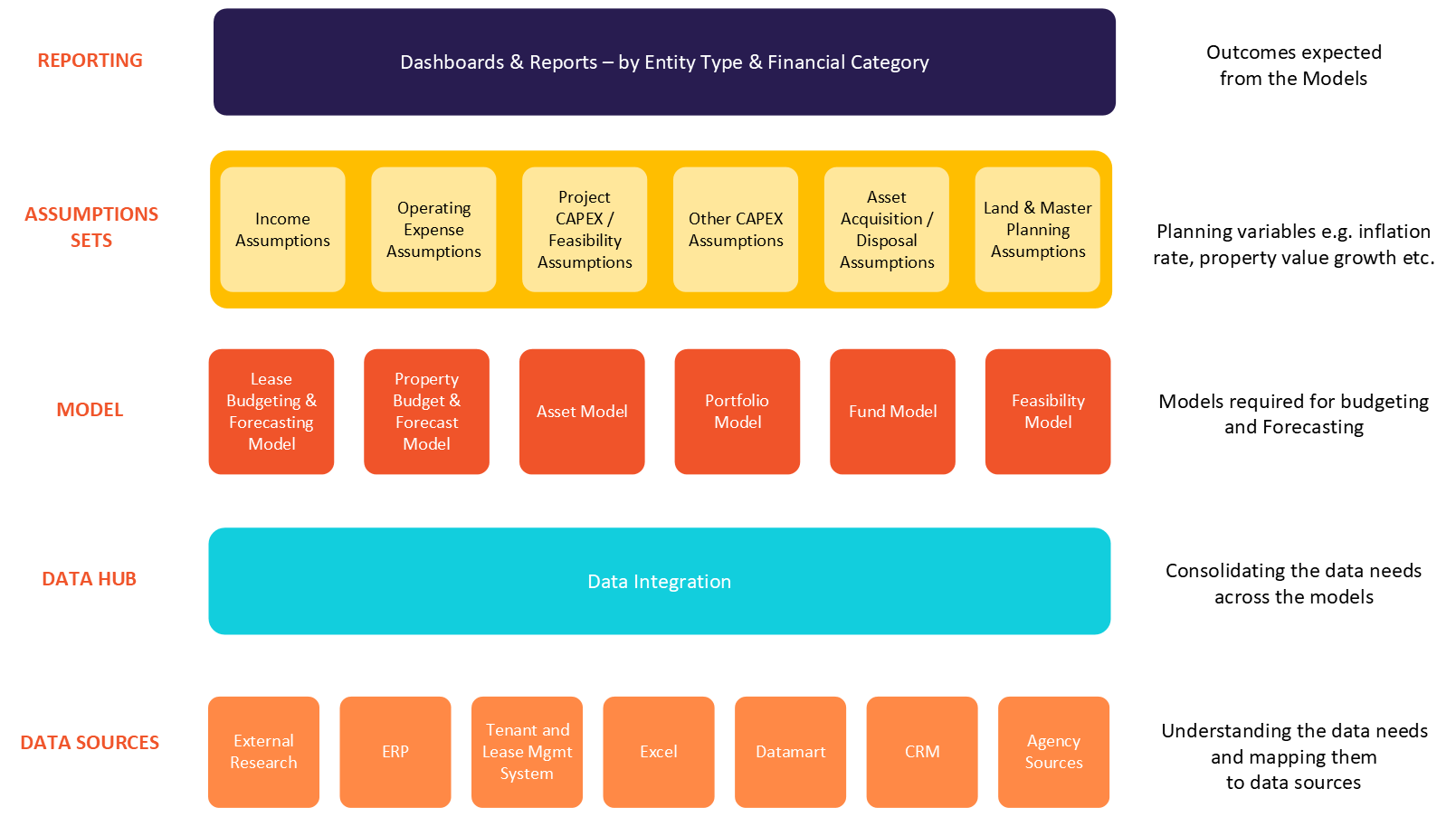

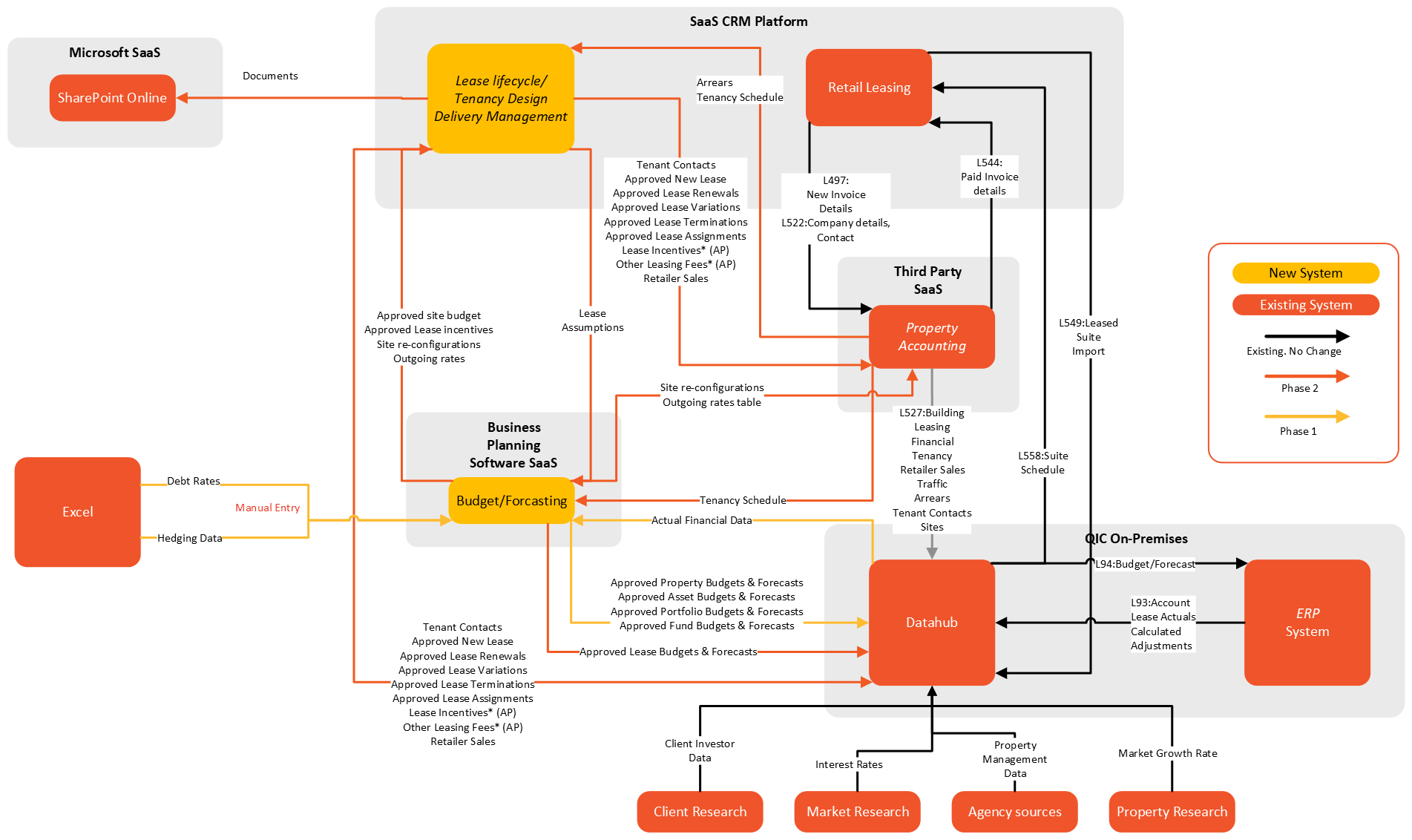

Our client, a major Real Estate Investment Trust, was looking to move away from traditional Excel-based Budgeting and Forecasting modelling, which was untimely, complex and error-prone and move to a structured and modern Corporate Performance Management (CPM) platform to deliver greater efficiency, scalability, and accessibility.

CHALLENGE

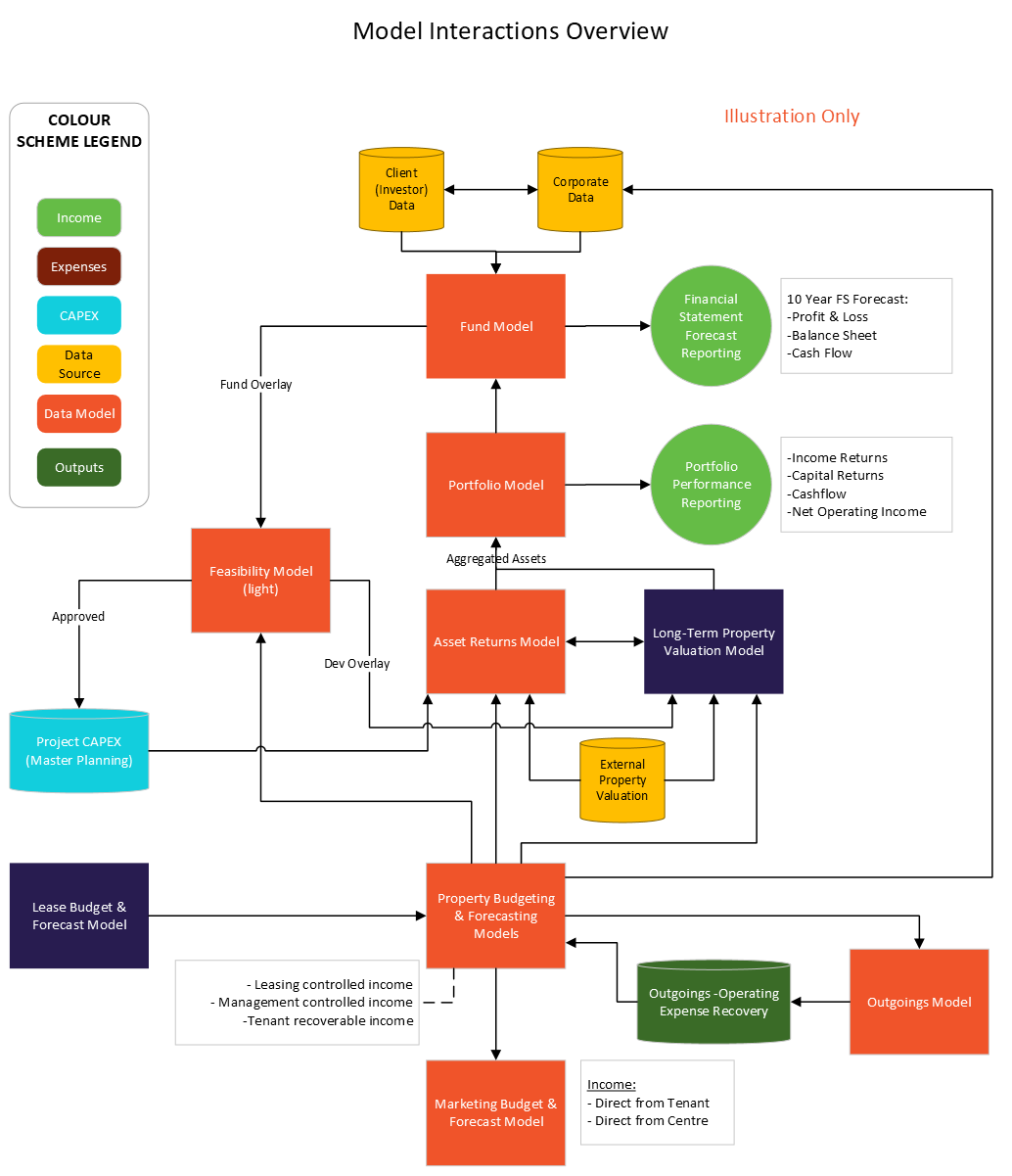

A series of complex, custom-built Excel-based models were in place supporting planning and decision-making across all business domains, included Property Management (Valuations, Leases, Asset Management, Marketing, etc.), Investment Management (Asset returns, Feasibility, etc.), and Fund Management.

Due to constraints within the existing business tools and technology, data quality issues, and process inefficiencies, the business encountered difficulties in making prompt, well-informed decisions. Using unsupported systems, notably Excel, had heightened operational risks, as these systems had reached their limits in handling complex modelling.

Our client had shortlisted a planning platform and had engaged Exent to build out the path to modern, fit-for-purpose Corporate Performance Management. This path included developing a target-state conceptual architecture, building and quantifying associated benefits, establishing a comprehensive transition roadmap and consolidating this into a robust business case.