Exent addressed banking client challenges through a two-stage approach: analysing operations and unifying processes under a best practice framework. The 18-month Execution Roadmap prioritised capabilities, resulting in a transformed approach to automation, improved risk alignment, and marked efficiency gains—a significant stride towards operational excellence.

The Client

An innovative regional Australian bank engaged Exent to build a process & operational excellence strategy for its next phase of transformation. With a number of inflight initiatives around lending transformation, core platform replacement, robotic process automation and risk programmes, the bank was looking for thought leadership in bringing a variety of strategies together under unified framework with process excellence at its core.

CHALLENGE

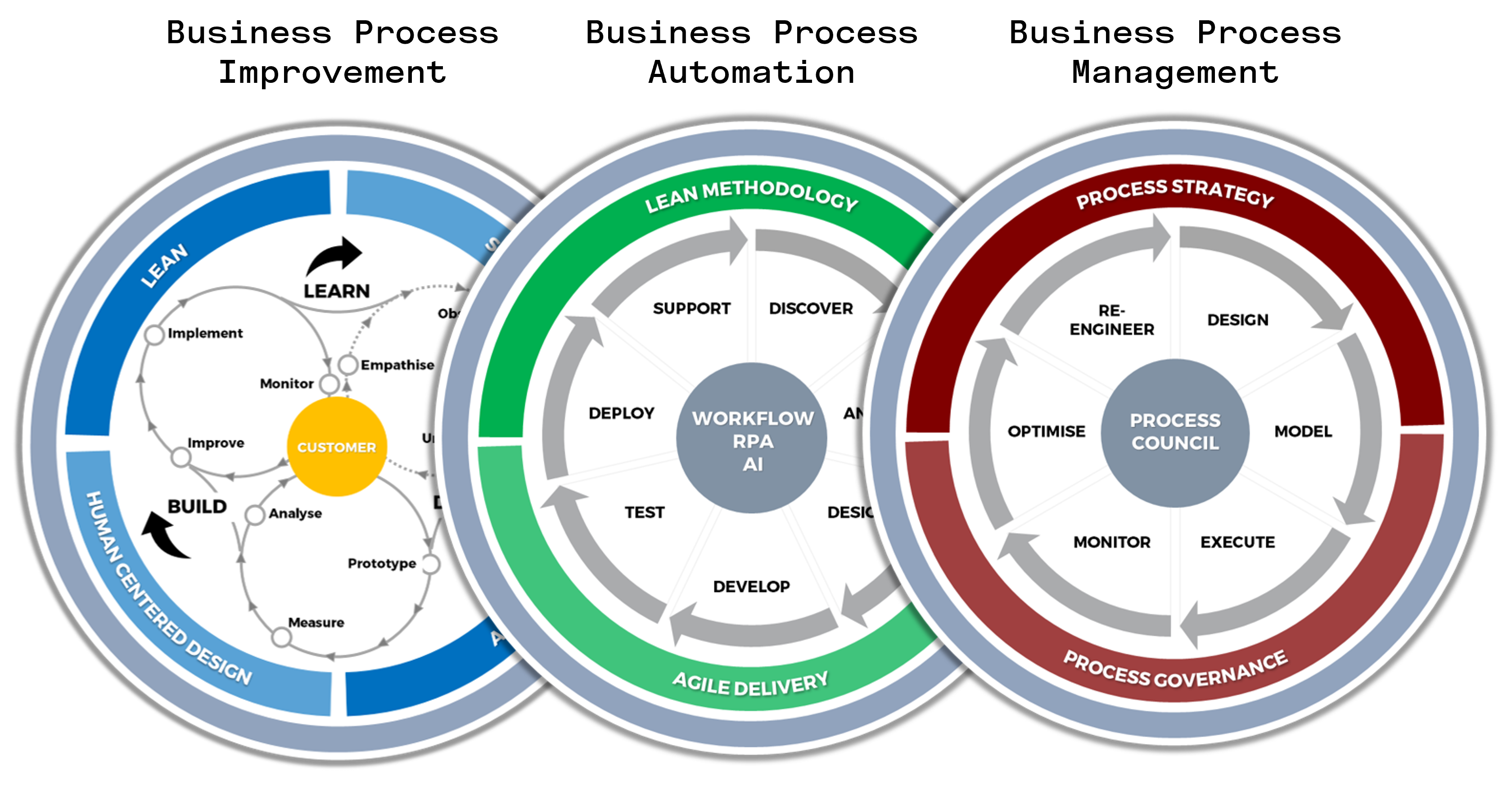

Despite having had measured success on a range of innovations within the bank’s Operations division, Exent’s client felt that more was needed. In particular, the internal capabilities and approaches to process management, process automation, first- and second-line risk management, and operational excellence needed review and improvement, with a view to bringing them together into a more cohesive whole as well as injecting truly best practice approaches to redesigning and optimising processes.

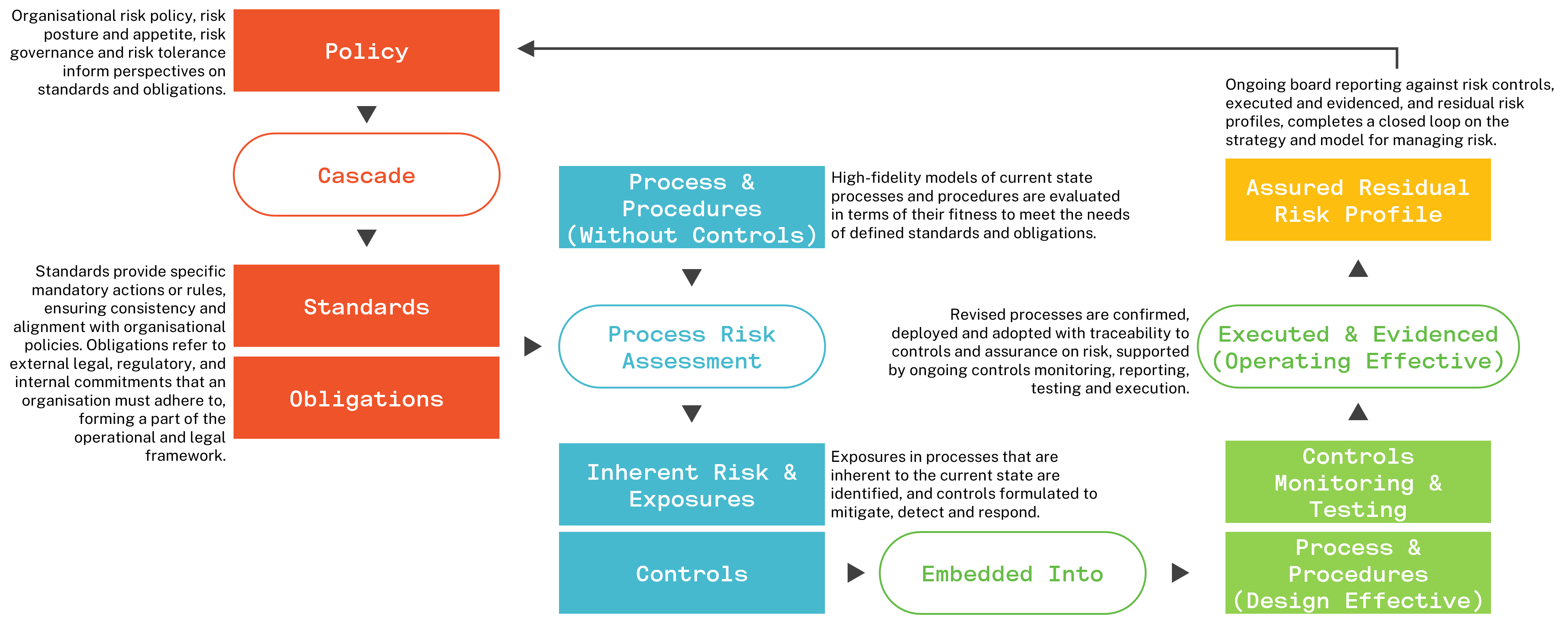

The client expressed a real intent to drive major improvements in its transformation journey, so the bar was set high for a strategic re-think of its model of process and operational excellence, aiming especially to address gaps in how risk is defined, cascaded to operational processes and controls, and assured in the design and delivery of front-line processes.

Exent was engaged to deliver a Process & Operational Excellence Strategy, with a review component to build on what was in place and working well, as well as defining a bold new target state with a high performing process excellence capability. The objective was a clear set of actionable findings, a roadmap and strategic outcomes defined that would be delivered or enabled as part of a future implementation.