In this solution spotlight, we provide an overview of the capabilities of Financial Insights – a new set of features within Microsoft’s Dynamics 365 ERP suite – that provides advanced forecasting and modelling capabilities powered by AI.

Financial Insights Overview

Intelligent financial solutions are needed as business advances at an unparalleled rate. Microsoft’s Dynamics 365 Financial Insights revolutionises financial forecasting and management with some innovative AI capabilities.

Financial Insights helps drive organisational efficiency and accuracy by projecting payment dates, revolutionising cash flow forecasts, and simplifying budget recommendations. This article explores how these capabilities help organisations to handle modern finance and transform finance operations.

Microsoft Dynamics 365 Financial Insights is an AI-powered package within the broader Dynamics 365 ERP solutions that brings predictive aspects to financial modelling and management. It revolutionises banking operations using AI and ML. Since Financial Insights is widely available, firms have few barriers to adoption in the quest to streamline financial operations and improve decision-making. This suite has three main parts:

- Cashflow Forecasting

- Customer Payment Insights

- Intelligent Budget Proposals

Cashflow Forecasting

All operations rely not just on sufficient cashflow, but on the accurate modelling and management of cash flow projections to ensure working capital adequacy and liquidity. Finance Insights’ intelligent cash flow forecasting combines data from external systems and uses machine learning to accurately modesl cashflow for next-level accuracy.

Managers can optimise prospects based on their cash status with this function. Cash flow forecasting gives a complete financial picture by combining time-series data and client payment estimates. The ability to compare projections to actual financial results improves future forecast performance.

The advantages of these new AI-powered capabilities include:

- Prevent liquidity concerns by precisely estimating cash flows.

- Apply real-time cash position data to financial decisions to maximise opportunities.

- Prevent financial surprises and enhance financial planning.

- Improve financial planning and resource allocation with accurate cash flow forecasts.

- Understand your cash position to maintain business continuity.

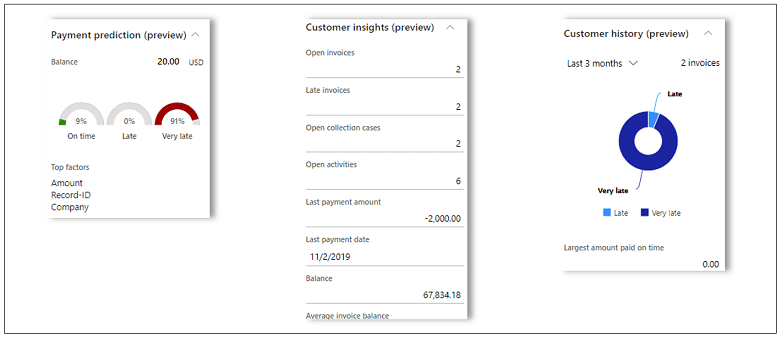

Customer Payment Insights

Underpinning the cashflow forecasting capabilities in Microsoft Dynamics 365 Financial Insights is the Customer Payment Insights capability which revolutionises collections administration. It uses AI and machine learning to accurately forecast when consumers will pay their bills, turning collections from reactive to proactive.

Businesses can improve cash flow accuracy and reduce late or defaulted payments by automating data-driven projections. This predictability ultimately increases financial stability, allows finance teams to focus on strategic responsibilities, and strengthens the organization’s financial base.

The benefits of this capability include:

- Use data-driven payment projections to automate follow-ups

- Predicting payment dates improves cash flow accuracy

- Reduce late or defaulted payments to improve financial stability

- Increase income predictability for better financial planning

- Allow finance teams to focus on strategic financial projects

Intelligent Budget Proposals

One of the major challenges with budgeting is scrubbing past data for accuracy and properly informing budgeting models. Intelligent Budget Proposals from Finance Insights simplifies multi-year budgets in aiding the accurate predictions of future spend based on past data.

The capability to quickly and accurately model line-level budget data is a transformational capability enabling finance departments and budget owners to move more rapidly through what is normally a complex, long-running process. The AI-driven business insights definitely support a faster and easier budgeting process. They also improve operational efficiency through intelligent automation. Key benefits include:

-

- Automation saves time and effort in budget value estimations

- Increase budget accuracy with detailed historical data analysis

- Streamline multi-year budgeting for efficiency

- Allow finance teams to focus on strategic and value-added duties

- Make better financial decisions with realistic budget estimates

Planning for Deployment

Enabling Finance Insights in a production context requires a number of environmental and data dependencies.

Firstly, Finance Insights requires Microsoft Dynamics 365 Finance 10.0.21 or later. Finance Insights computes financial forecasts using AI Builder credits. Each Dynamics 365 Finance tenant receives 20,000 AI Builder credits per month with their licence. You should also recognise that Finance Insights system requires a Tier-2 (multi-box) environment.

More importantly, there are historical data requirements as for any AI training and modelling exercise. Customer Payment Predictions require at least one year of customer invoices, Cash Flow Forecasts three years, and Intelligent Budget Proposals three years of budget and/or actuals to train machine learning models.

Summary

In summary, Finance Insights is an effective toolbox that, with the use of AI and intelligent automation, promises to completely transform the accuracy and timeliness of key financial management activities.

By utilising features like cash flow forecasting, intelligent budget recommendations, and customer payment analytics, firms may achieve a competitive advantage through data-driven decision-making, enhanced operational efficiency, and proactive financial process management.

| Capabilities | Benefits |

|---|---|

| Cashflow Forecasting |

|

| Customer Payment Insights |

|

| Intelligent Budget Proposals |

|